Fiscal Calendar: July 2024 to June 2025

Related Articles: Fiscal Calendar: July 2024 to June 2025

- April May June 2024 Calendar: A Comprehensive Overview

- July 2024 Through June 2025 Calendar

- Editable Calendar June 2024: Your Comprehensive Guide To A Flexible And Personalized Schedule

- June 2024 Calendar

- Calendar March To June 2024

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Fiscal Calendar: July 2024 to June 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Fiscal Calendar: July 2024 to June 2025

Fiscal Calendar: July 2024 to June 2025

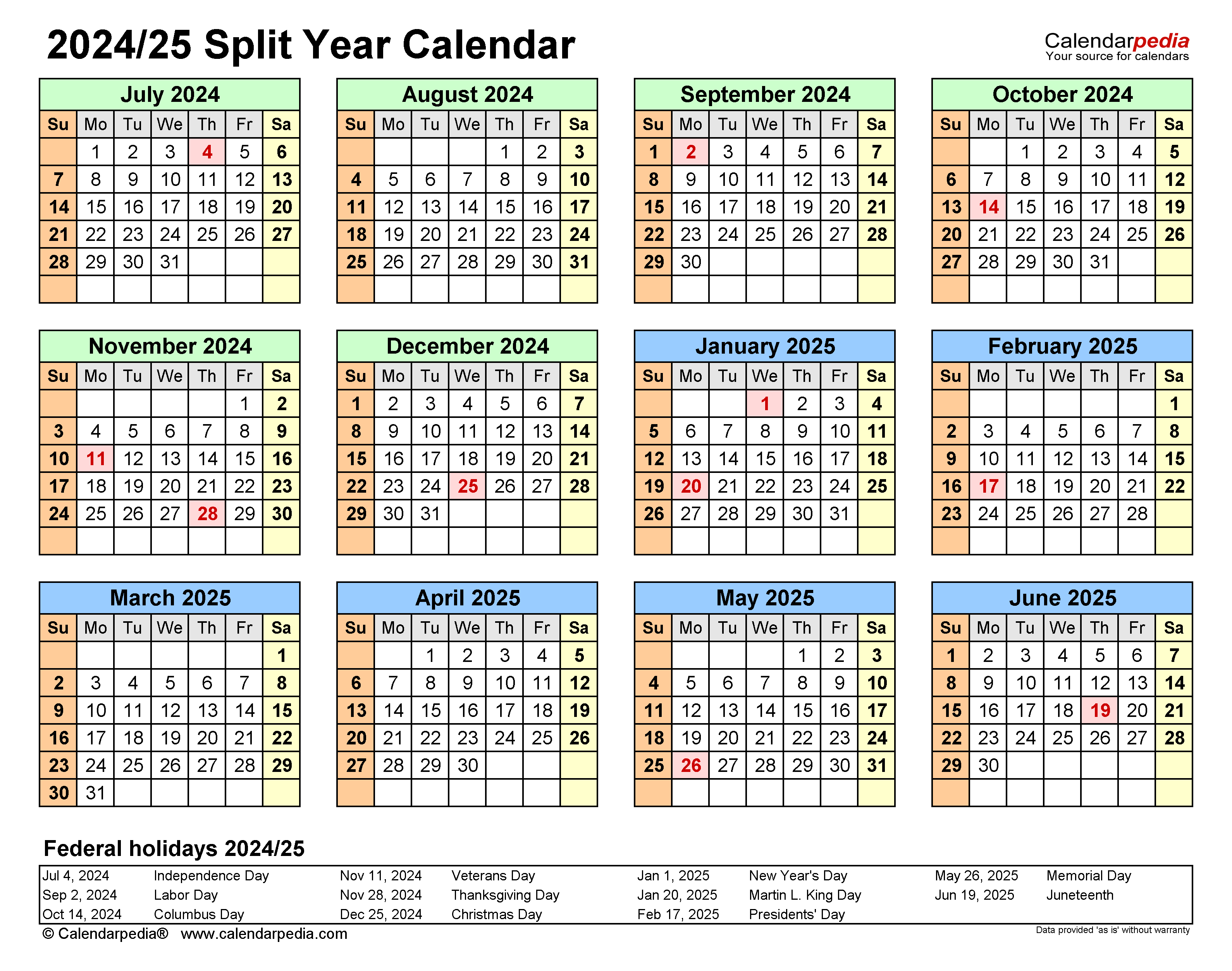

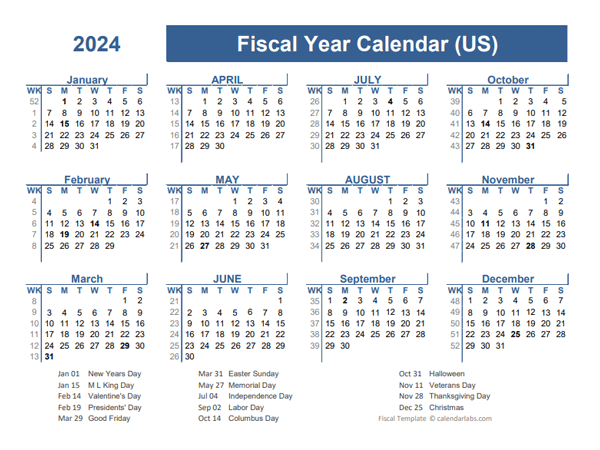

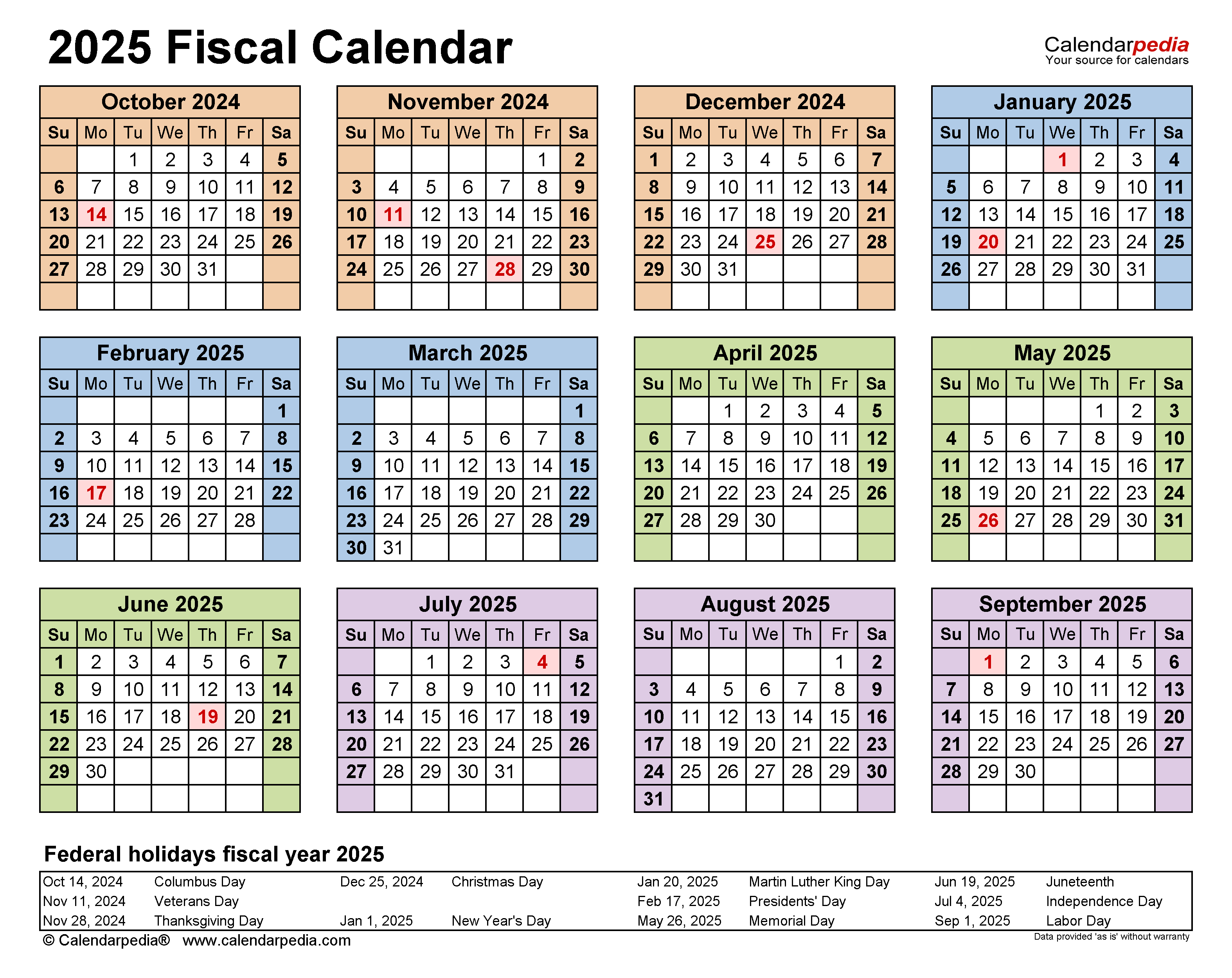

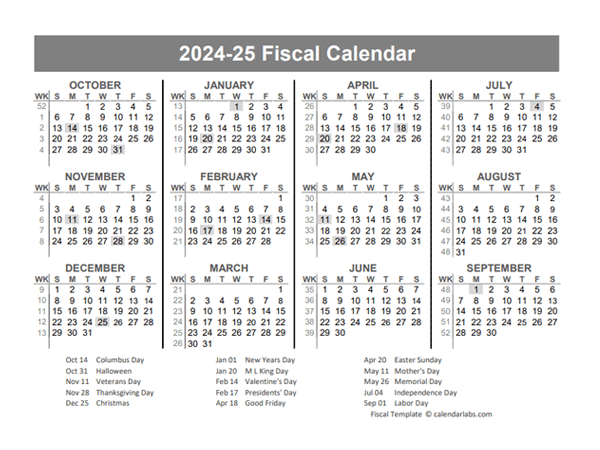

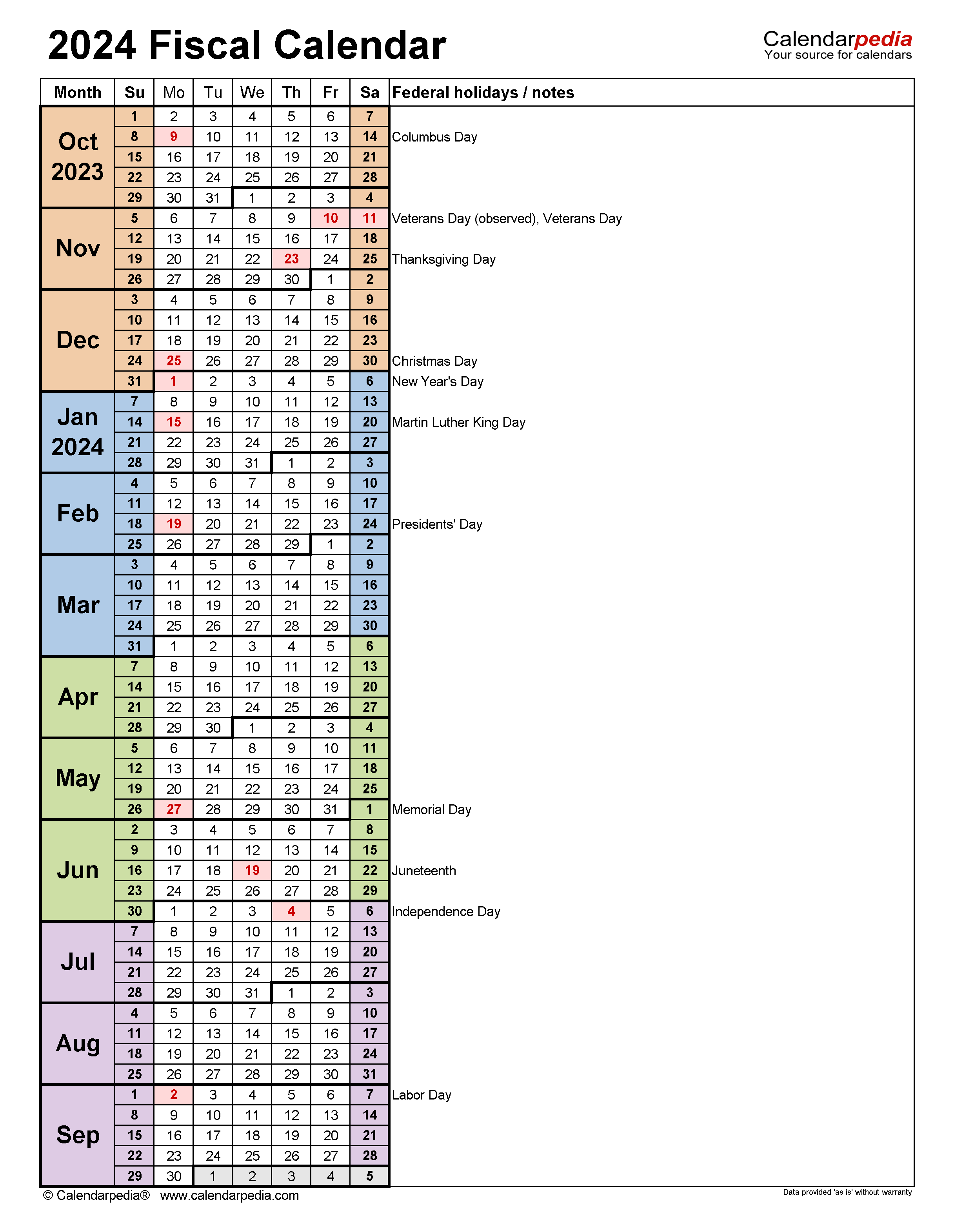

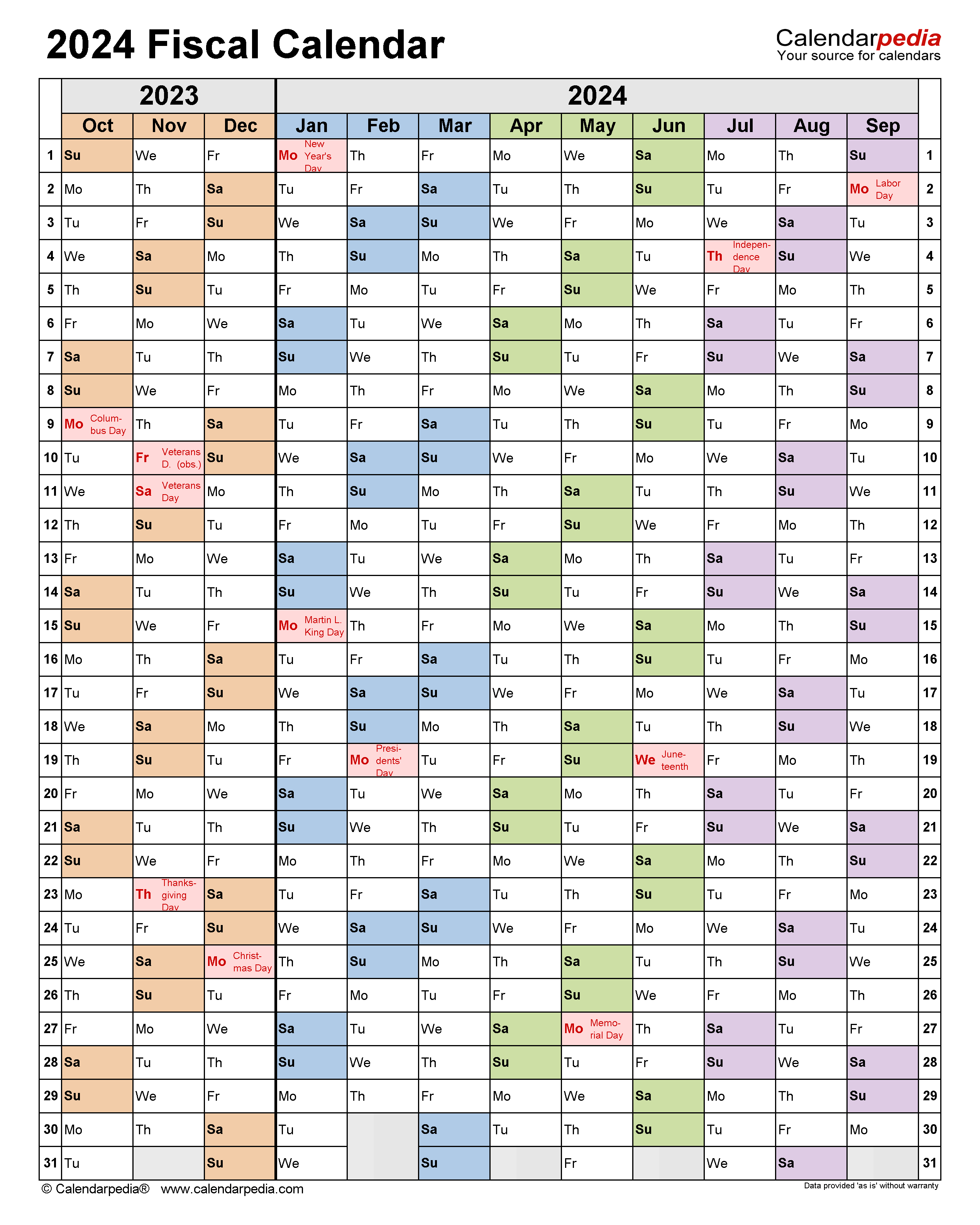

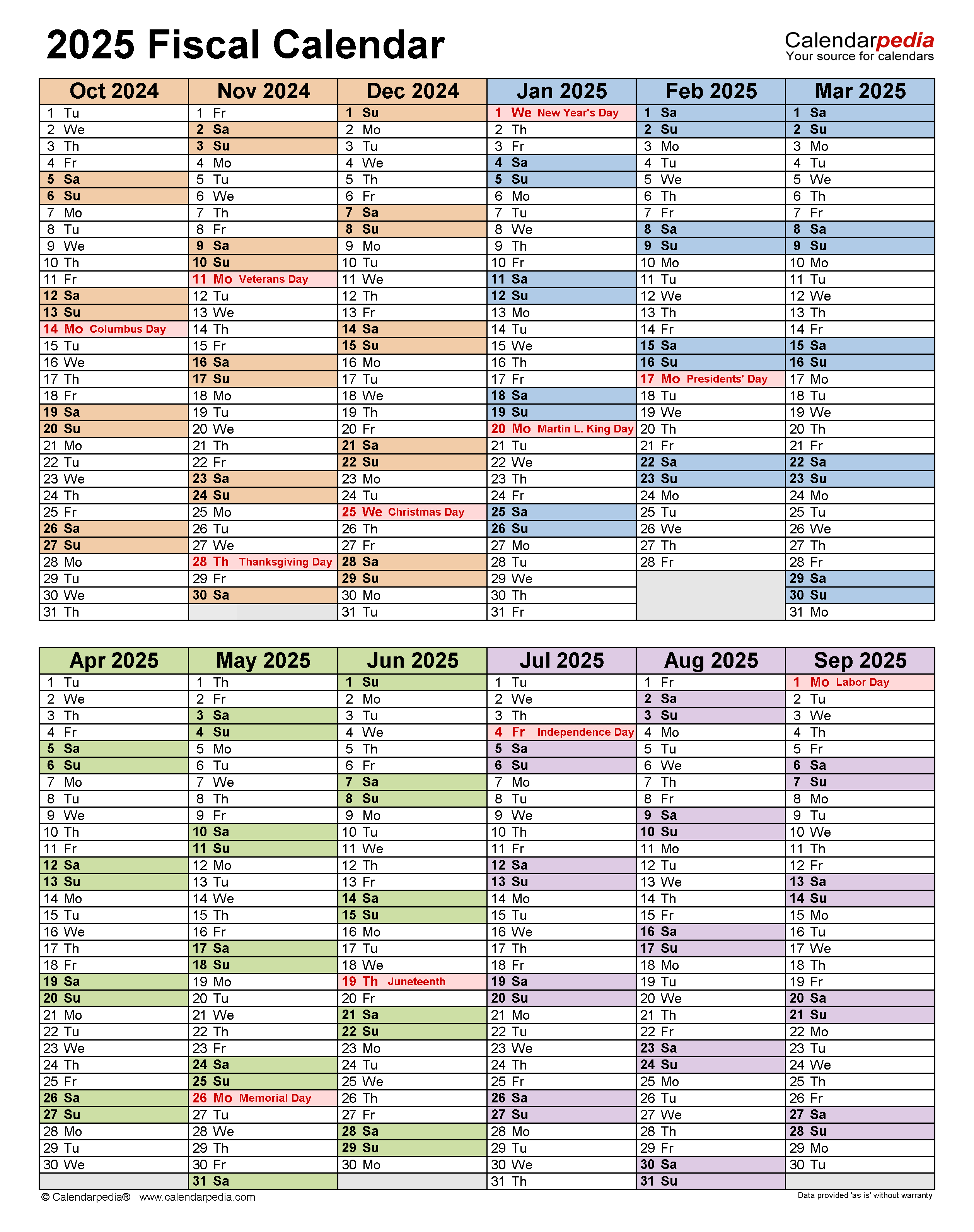

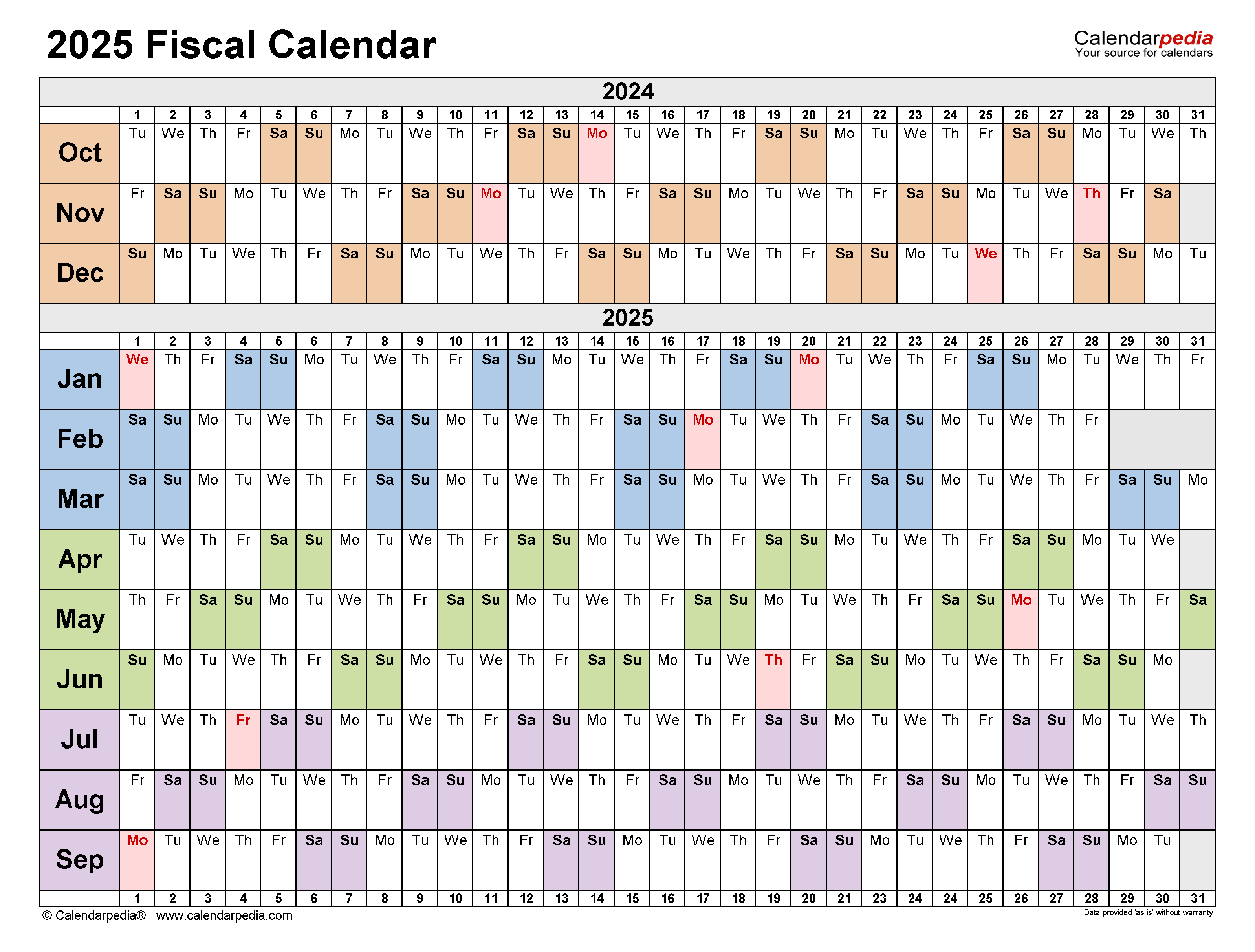

The fiscal calendar is a comprehensive overview of the key dates and deadlines for financial reporting and compliance obligations in a specific period. It provides a structured and organized approach to managing financial responsibilities and ensuring timely and accurate reporting. This article presents the fiscal calendar for the period of July 2024 to June 2025, outlining the essential dates for businesses and individuals to adhere to.

July 2024

- July 15th: Deadline for filing Form 941, Employer’s Quarterly Federal Tax Return, for the second quarter of 2024.

- July 31st: Deadline for filing Form 1040-ES, Estimated Tax for Individuals, for the third quarter of 2024.

August 2024

- August 15th: Deadline for filing Form 941, Employer’s Quarterly Federal Tax Return, for the third quarter of 2024.

September 2024

- September 15th: Deadline for filing Form 1040-ES, Estimated Tax for Individuals, for the fourth quarter of 2024.

- September 30th: Deadline for filing Form 1099-MISC, Miscellaneous Income, for payments made in 2023.

October 2024

- October 15th: Deadline for filing Form 941, Employer’s Quarterly Federal Tax Return, for the fourth quarter of 2024.

- October 31st: Deadline for filing Form 1120, U.S. Corporation Income Tax Return, for the 2023 tax year.

November 2024

- November 15th: Deadline for filing Form 1040, U.S. Individual Income Tax Return, for the 2023 tax year.

- November 30th: Deadline for filing Form 1065, U.S. Return of Partnership Income, for the 2023 tax year.

December 2024

- December 15th: Deadline for filing Form 945, Annual Return of Withheld Federal Income Tax, for the 2024 tax year.

- December 31st: Deadline for filing Form W-2, Wage and Tax Statement, for employees for the 2024 tax year.

January 2025

- January 15th: Deadline for filing Form 1099-NEC, Nonemployee Compensation, for payments made in 2024.

- January 31st: Deadline for filing Form 941, Employer’s Quarterly Federal Tax Return, for the first quarter of 2025.

February 2025

- February 15th: Deadline for filing Form 1040-ES, Estimated Tax for Individuals, for the first quarter of 2025.

March 2025

- March 15th: Deadline for filing Form 941, Employer’s Quarterly Federal Tax Return, for the second quarter of 2025.

- March 31st: Deadline for filing Form 1040-ES, Estimated Tax for Individuals, for the second quarter of 2025.

April 2025

- April 15th: Deadline for filing Form 1040, U.S. Individual Income Tax Return, for the 2024 tax year.

- April 30th: Deadline for filing Form 1065, U.S. Return of Partnership Income, for the 2024 tax year.

May 2025

- May 15th: Deadline for filing Form 941, Employer’s Quarterly Federal Tax Return, for the third quarter of 2025.

- May 31st: Deadline for filing Form 1040-ES, Estimated Tax for Individuals, for the third quarter of 2025.

June 2025

- June 15th: Deadline for filing Form 941, Employer’s Quarterly Federal Tax Return, for the fourth quarter of 2025.

- June 30th: Deadline for filing Form 1120, U.S. Corporation Income Tax Return, for the 2024 tax year.

Additional Notes:

- The fiscal calendar is subject to change, so it is advisable to consult with the relevant tax authorities for the most up-to-date information.

- Businesses and individuals are encouraged to prepare for these deadlines in advance to ensure timely and accurate reporting.

- Failure to meet these deadlines may result in penalties and interest charges.

- Electronic filing is recommended for efficient and timely submission of tax returns.

- Taxpayers should consult with a qualified tax professional for personalized guidance and assistance with tax compliance.

By adhering to the fiscal calendar, businesses and individuals can effectively manage their financial obligations, minimize penalties, and ensure compliance with tax regulations. Proper planning and timely reporting are essential for maintaining financial health and avoiding unnecessary complications.

Closure

Thus, we hope this article has provided valuable insights into Fiscal Calendar: July 2024 to June 2025. We hope you find this article informative and beneficial. See you in our next article!