Fiscal Year Calendar: July 2024 to June 2025

Related Articles: Fiscal Year Calendar: July 2024 to June 2025

- April To June Calendar 2024: A Comprehensive Overview

- June 2024 Calendar

- June 2024 To March 2025 Calendar

- May 2024 Calendar

- June And July 2024 Calendar: A Comprehensive Overview

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Fiscal Year Calendar: July 2024 to June 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Fiscal Year Calendar: July 2024 to June 2025

Fiscal Year Calendar: July 2024 to June 2025

Introduction

A fiscal year is a 12-month period used for accounting and financial reporting purposes. It is typically different from the calendar year, which runs from January 1 to December 31. The fiscal year is often used by businesses and organizations to align with their operating cycles or to take advantage of tax benefits.

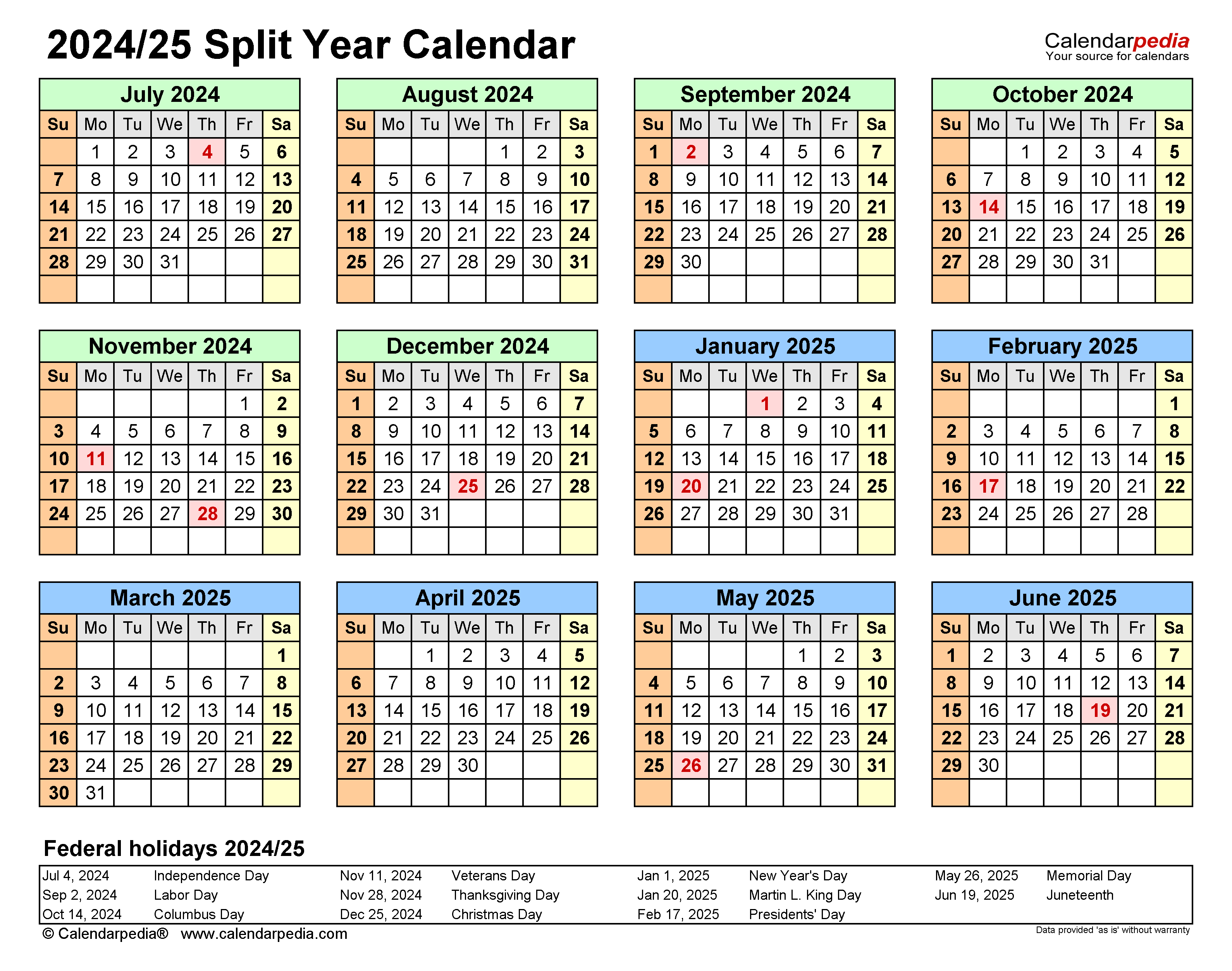

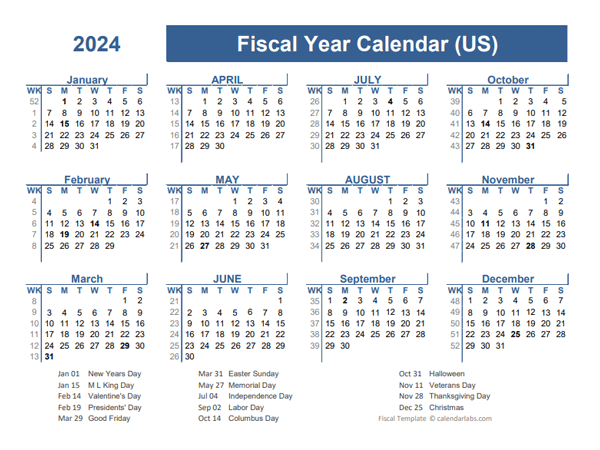

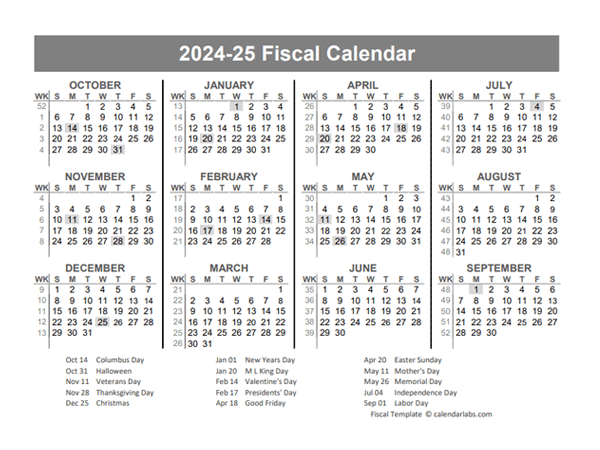

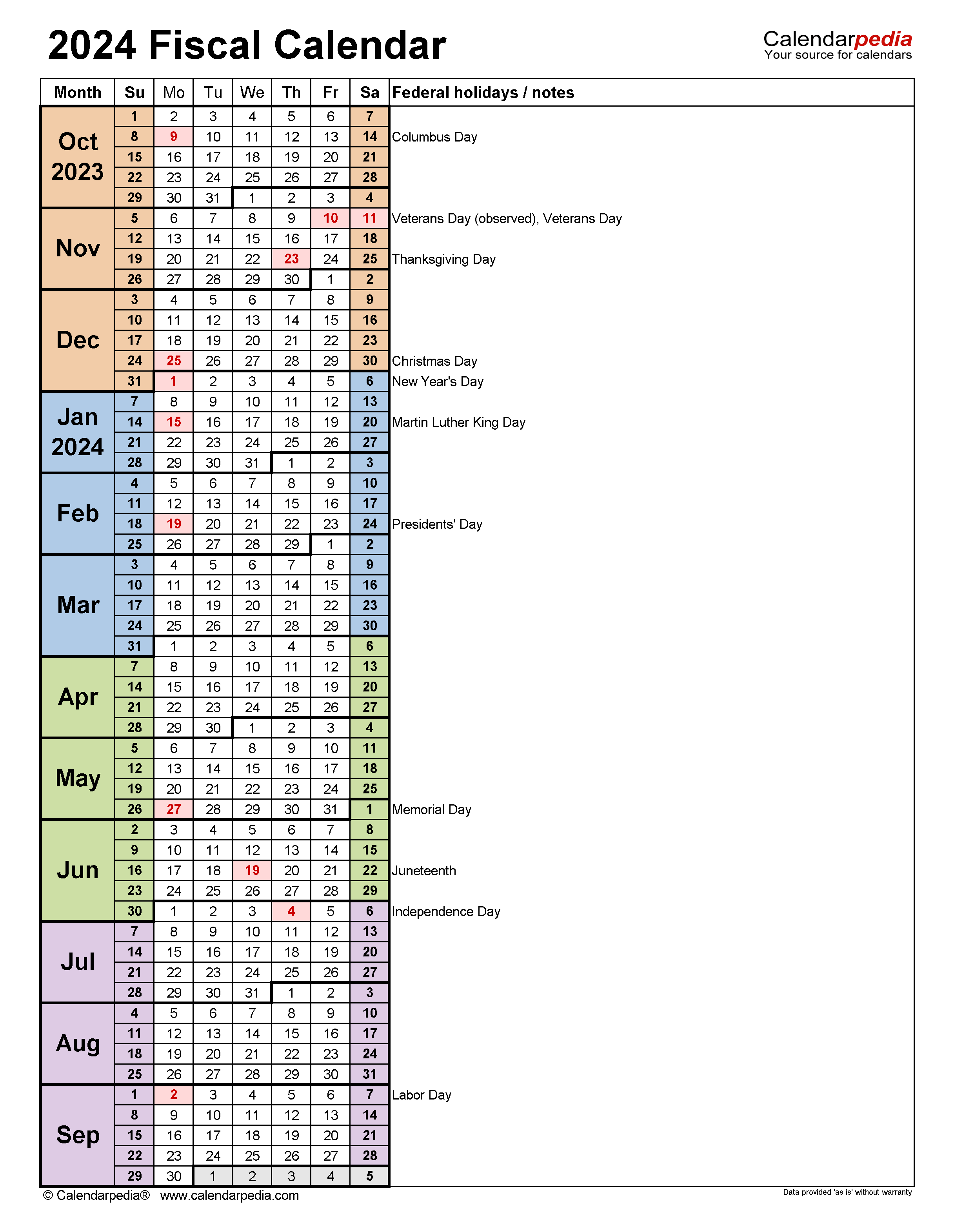

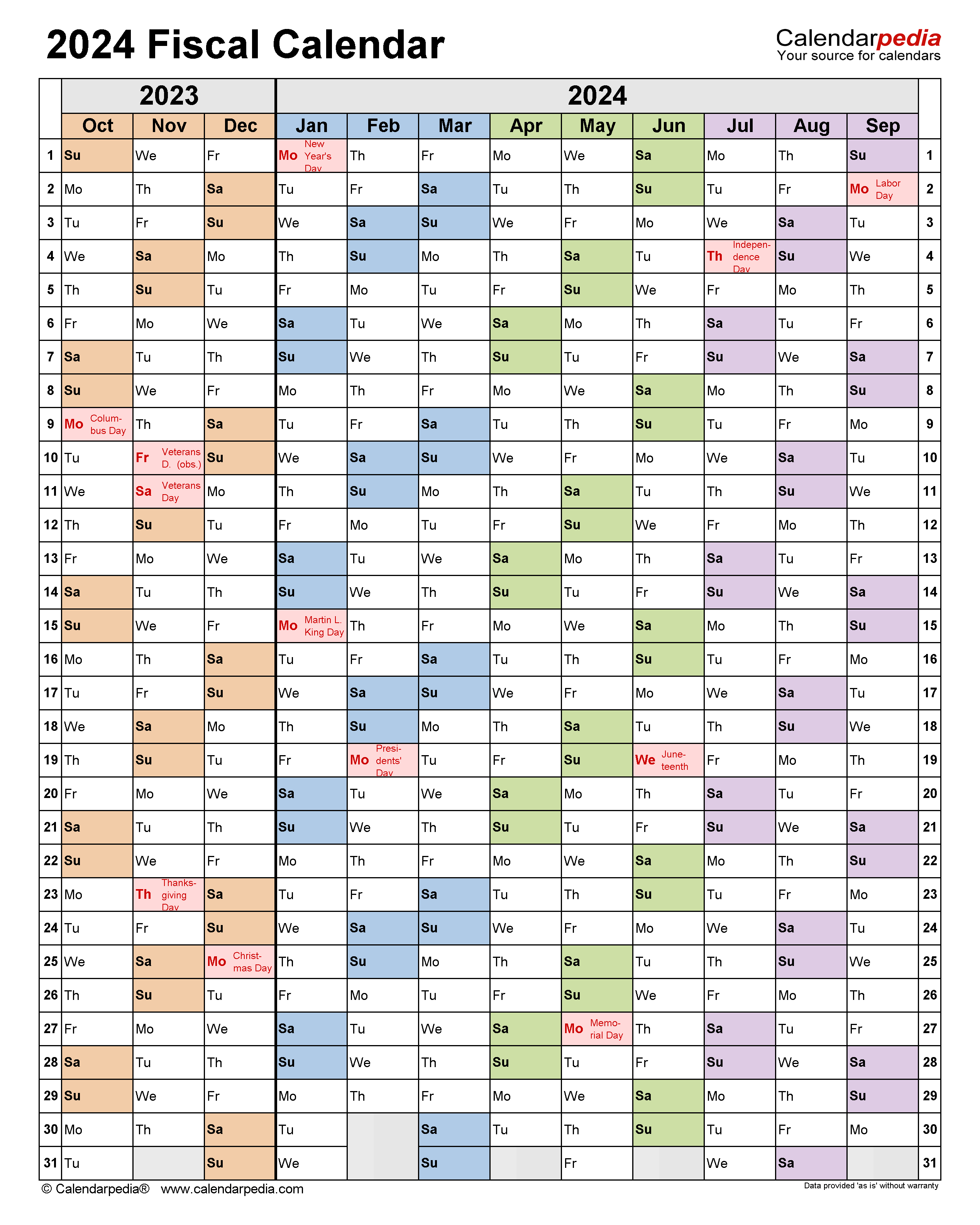

July 2024 to June 2025 Fiscal Year Calendar

The following table shows the fiscal year calendar for July 2024 to June 2025:

| Month | Days |

|---|---|

| July 2024 | 31 |

| August 2024 | 31 |

| September 2024 | 30 |

| October 2024 | 31 |

| November 2024 | 30 |

| December 2024 | 31 |

| January 2025 | 31 |

| February 2025 | 28 |

| March 2025 | 31 |

| April 2025 | 30 |

| May 2025 | 31 |

| June 2025 | 30 |

Benefits of Using a Fiscal Year Calendar

There are several benefits to using a fiscal year calendar, including:

- Alignment with operating cycles: A fiscal year can be aligned with the natural operating cycle of a business or organization. This can make it easier to track financial performance and make comparisons over time.

- Tax benefits: Some businesses and organizations may be able to take advantage of tax benefits by using a fiscal year. For example, a business may be able to defer income taxes by starting its fiscal year in a month when it typically has lower profits.

- Flexibility: A fiscal year can be customized to meet the specific needs of a business or organization. This flexibility can be helpful for businesses that operate in multiple countries or have complex financial structures.

Disadvantages of Using a Fiscal Year Calendar

There are also some disadvantages to using a fiscal year calendar, including:

- Complexity: A fiscal year calendar can be more complex than a calendar year. This can make it more difficult to track financial performance and make comparisons over time.

- Confusion: A fiscal year calendar can be confusing for employees and customers who are used to the calendar year. This can lead to errors and misunderstandings.

- Lack of standardization: There is no universal standard for fiscal years. This can make it difficult to compare financial data between different businesses and organizations.

Choosing a Fiscal Year

When choosing a fiscal year, businesses and organizations should consider the following factors:

- Operating cycle: The fiscal year should be aligned with the natural operating cycle of the business or organization.

- Tax benefits: The fiscal year should be chosen to take advantage of any available tax benefits.

- Flexibility: The fiscal year should be flexible enough to meet the specific needs of the business or organization.

Conclusion

A fiscal year calendar can be a valuable tool for businesses and organizations. However, it is important to carefully consider the benefits and disadvantages of using a fiscal year calendar before making a decision. By carefully choosing a fiscal year and implementing it properly, businesses and organizations can improve their financial reporting and take advantage of tax benefits.

Closure

Thus, we hope this article has provided valuable insights into Fiscal Year Calendar: July 2024 to June 2025. We thank you for taking the time to read this article. See you in our next article!